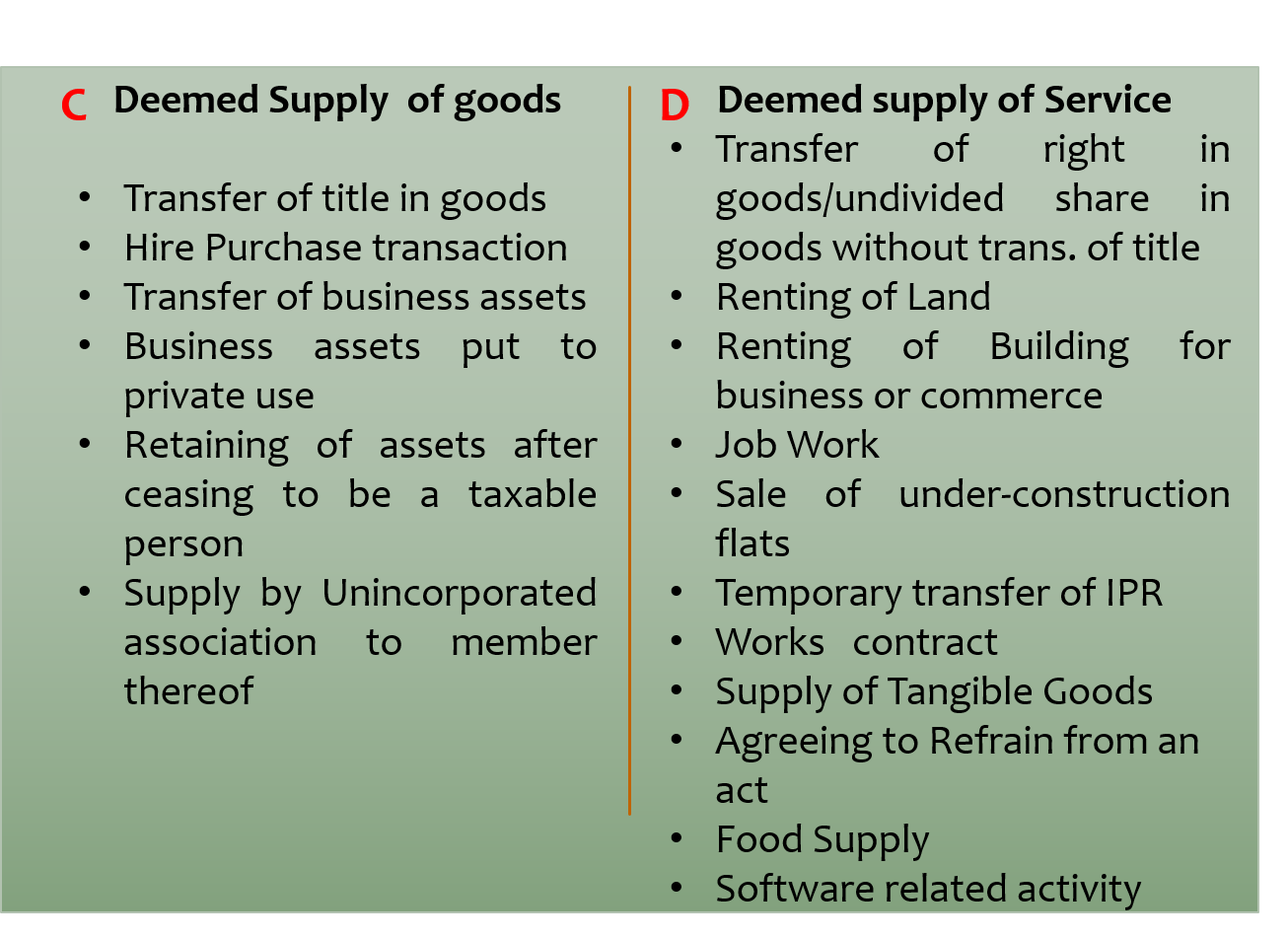

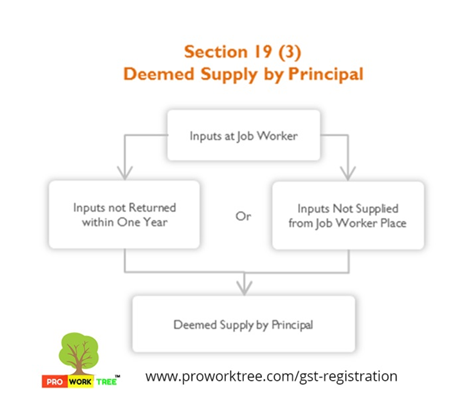

Contract involves Services, as well as Supply/Deemed Supply of Goods, can only Classify under head 'Works Contract Services': CESTAT

CESTAT | Services involving supply of goods/deemed supply of goods to be classified under 'works contract services' only | SCC Blog